Insightful Chronicles

Your daily dose of news, updates, and insights.

Blockchain: The New Black Gold of Digital Assets

Discover why blockchain is the new black gold of digital assets and how it’s transforming the future of finance and investment!

How Blockchain is Revolutionizing Asset Management

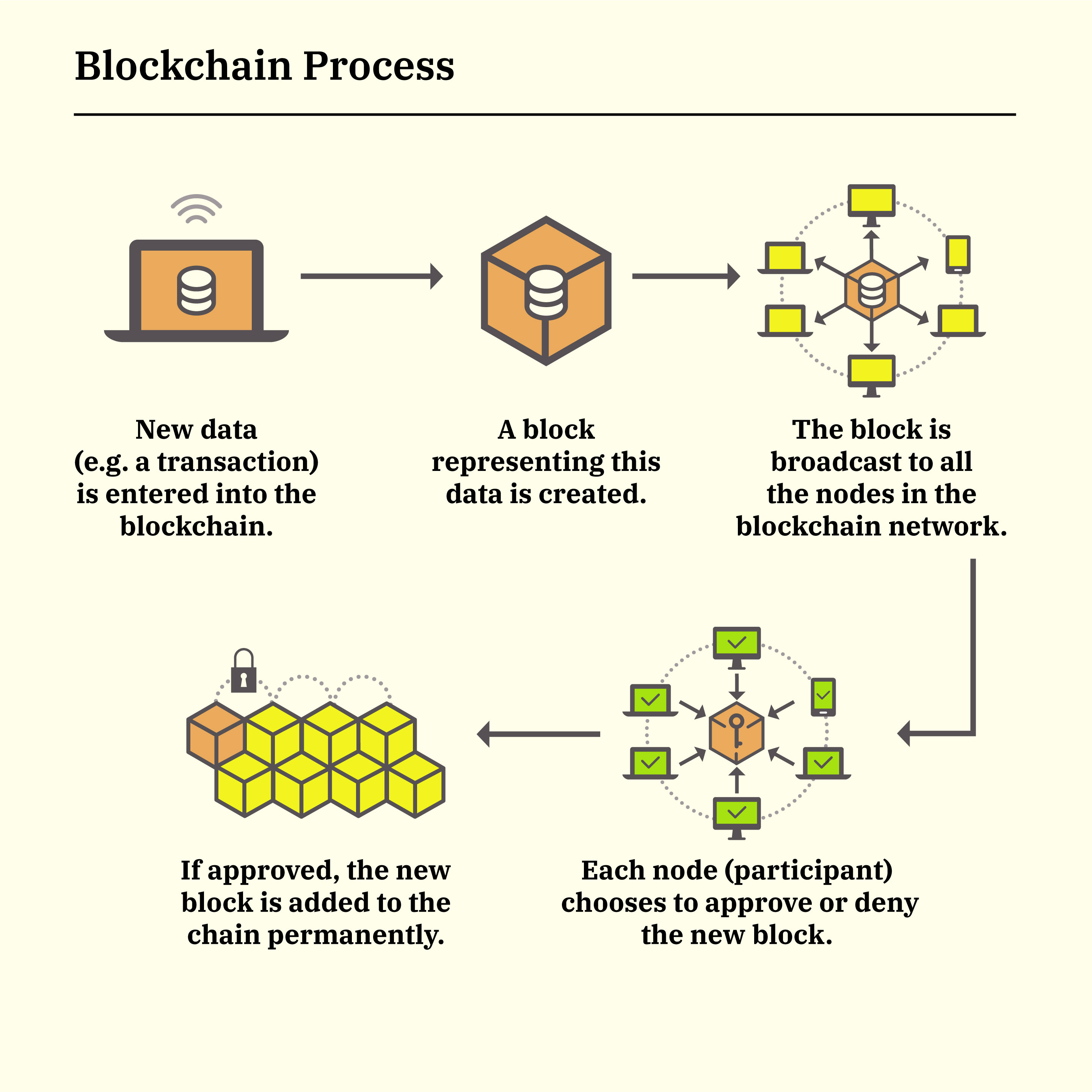

The blockchain technology is fundamentally transforming the way asset management operates. By providing a decentralized, transparent, and secure framework for transactions, blockchain enhances the efficiency and accountability of asset management processes. Traditional methods often face challenges such as fraud, high costs, and delays in settlements; however, with blockchain, each transaction is recorded on a public ledger that is accessible to all parties involved, thus significantly reducing the risk of manipulation and enhancing trust. Additionally, the elimination of intermediaries can lead to lower transaction fees and faster execution times, directly benefiting investors and institutions alike.

Another significant impact of blockchain on asset management is the democratization of investment opportunities. With the advent of tokenization, tangible and intangible assets can be broken down into smaller units, allowing a broader range of investors to participate in markets that were previously inaccessible due to high capital requirements. For instance, real estate and art can now be tokenized, enabling fractional ownership. This shift not only opens new avenues for diversification and increased liquidity but also encourages a more inclusive investment landscape, where everyday investors can engage in wealth-building opportunities.

The Future of Investments: Why Blockchain is Considered Digital Gold

The financial landscape is rapidly evolving, with blockchain technology emerging as a paradigm shift in how we view and manage investments. Often referred to as digital gold, blockchain offers a decentralized, transparent, and secure method of transacting value, akin to how gold has been recognized for centuries. Unlike traditional currencies, which are susceptible to inflation and government manipulation, assets secured by blockchain retain their value due to finite supply and robust technological infrastructure. This paradigm places blockchain in a favorable position as a contemporary store of value, drawing parallels with precious metals in times of economic uncertainty.

Furthermore, the rise of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) are reshaping investment strategies, further solidifying blockchain as a cornerstone of future wealth management. Investors are increasingly turning to these innovative tools, which leverage blockchain to offer unprecedented liquidity and ownership verification. As these developments continue to expand, the allure of digital gold strengthens, attracting both millennials and seasoned investors seeking diversified portfolios. With every transaction recorded immutably on the blockchain, the confidence in digital assets grows, paving the way for a more secure financial future.

What Makes Blockchain the New Frontier in Digital Asset Ownership?

Blockchain technology is revolutionizing the concept of digital asset ownership by providing an immutable, transparent, and decentralized platform for transactions. Unlike traditional systems, where intermediaries often play a crucial role, blockchain eliminates the need for centralized authorities, thereby reducing costs and enhancing efficiency. With features such as cryptographic security and distributed ledgers, users can confidently manage their digital assets, ensuring that ownership records are accurate and tamper-proof. This fundamental shift encourages trust and democratizes access, making it easier for individuals to engage in markets previously dominated by large financial entities.

The rise of blockchain has given birth to innovative concepts such as non-fungible tokens (NFTs) and decentralized finance (DeFi), further solidifying its role as the new frontier in digital asset ownership. Blockchain enables true ownership through unique tokenization methods, allowing individuals to possess digital art, memorabilia, and even real estate in a secure and verifiable manner. As more users and businesses recognize the potential of blockchain, we can expect to see a significant shift in how digital assets are valued and traded, making it essential for stakeholders to stay informed and adapted to this transformative technology.