Insightful Chronicles

Your daily dose of news, updates, and insights.

Life Insurance: The Safety Net You Didn't Know You Needed

Discover why life insurance is the safety net you didn't know you needed—protect your loved ones and secure their future today!

Understanding the Basics of Life Insurance: What You Need to Know

Understanding the basics of life insurance is crucial for anyone looking to secure financial protection for their loved ones. Life insurance is essentially a contract between the policyholder and the insurer, where the insurer agrees to pay a designated beneficiary a sum of money upon the policyholder's death, in exchange for regular premium payments. There are different types of life insurance, such as term life and whole life policies, each serving unique purposes. For a detailed comparison of these options, you might find this resource from Investopedia helpful.

When considering life insurance, it’s important to evaluate your financial situation and understand how different policies can fit into your overall financial plan. Life insurance can be an effective tool not just for providing death benefits, but also for estate planning and wealth transfer strategies. To grasp the essential factors to direct your choice on a life insurance policy, check out this comprehensive guide from NerdWallet. Being informed can lead to better decisions that ensure peace of mind for both you and your family.

The Benefits of Life Insurance: Protecting Your Loved Ones

Life insurance is a crucial financial tool that provides protection for your loved ones in the event of your unexpected demise. By securing a life insurance policy, you ensure that your family is not burdened with financial stress during an already challenging time. The coverage can help pay off debts, cover daily living expenses, and fund future needs such as education for your children. According to NerdWallet, life insurance can serve as a financial safety net that allows your loved ones to maintain their quality of life while they grieve and adjust.

Moreover, life insurance policies can come with additional benefits that contribute to a secure financial future. Many plans offer a cash value component that grows over time, allowing policyholders to borrow against it if necessary. This aspect of life insurance can be a viable asset for long-term financial planning. As highlighted by Investopedia, having a life insurance policy not only offers peace of mind but also acts as a strategic investment in your family's future.

Is Life Insurance Right for You? Key Questions to Consider

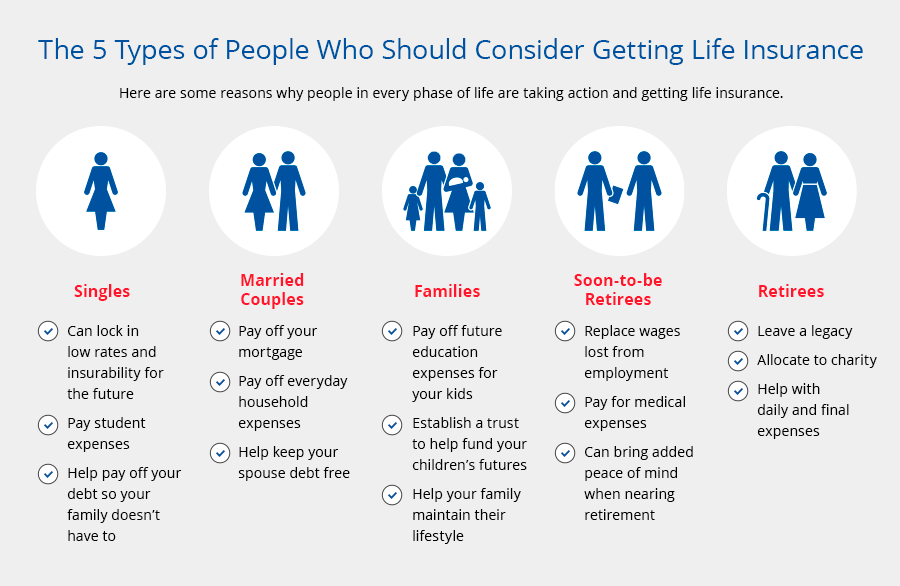

Deciding whether life insurance is right for you is a significant financial choice that requires careful consideration. Begin by evaluating your current life stage and financial responsibilities. Are you married or do you have dependents who rely on your income? If so, life insurance can provide crucial financial support in the event of your untimely passing, ensuring that your loved ones can maintain their standard of living. For a comprehensive view of how life insurance can impact families, visit Insurance Info.

Another key question to ponder is your long-term financial goals. Do you have debts, such as a mortgage or loans, that would need to be settled? Do you want to leave a legacy or cover future expenses like education for your children? Life insurance can not only cover immediate needs but can also serve as part of your overall financial strategy. Explore your options and the benefits of different types of policies at Policygenius to ensure you make the best choice based on your personal situation.