Insightful Chronicles

Your daily dose of news, updates, and insights.

Banking on Change: Embracing the Future of Finance

Discover how to thrive in the evolving financial landscape. Uncover trends, tools, and insights shaping the future of banking!

The Rise of Digital Banking: How Fintech is Reshaping Financial Services

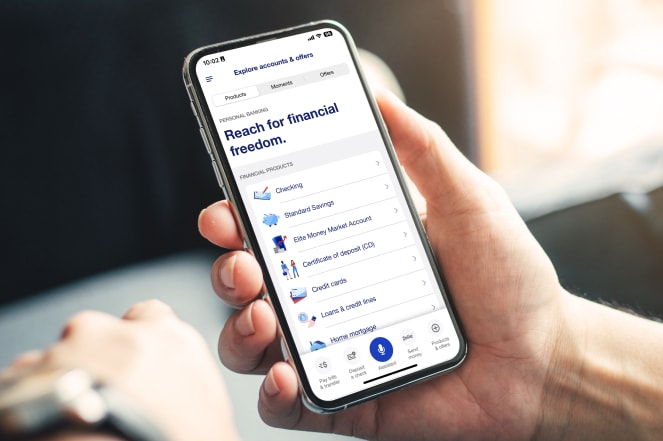

The landscape of finance is undergoing a significant transformation thanks to the rise of digital banking. Traditional banks are increasingly being challenged by fintech companies that leverage technology to offer innovative financial services. These digital platforms provide consumers with convenience and accessibility, allowing them to manage their finances directly from their smartphones. The advent of mobile banking apps and online account management has made it easier for users to perform transactions, track spending, and access financial advice, all without stepping into a physical bank branch.

The impact of fintech on financial services extends beyond just convenience. With advanced technologies like artificial intelligence, blockchain, and data analytics, digital banking is enabling personalized financial solutions for users. For example, AI-driven budgeting tools offer tailored insights to help customers make informed decisions about their spending habits. Furthermore, peer-to-peer lending and crowdfunding platforms are disrupting traditional loan processes, offering more choices and reducing the overall cost of borrowing. As this trend continues, we can expect to see further innovation that will redefine how we interact with our finances.

Navigating Cryptocurrency: What You Need to Know for the Future of Finance

Navigating Cryptocurrency is essential in today's financial landscape as digital currencies continue to gain traction. Understanding the fundamentals of cryptocurrency, including how it works and its underlying technology, is crucial for anyone looking to invest or engage with this evolving market. With a multitude of options available, such as Bitcoin, Ethereum, and countless altcoins, making informed choices is vital. Here are some key concepts to grasp:

- What is cryptocurrency?

- The importance of blockchain technology

- How to buy, store, and trade digital assets

As we look to the future of finance, it's important to recognize the potential risks and benefits associated with cryptocurrencies. Volatility is a notable characteristic, leading to both significant gains and losses for investors. Additionally, understanding the regulatory landscape is crucial, as governments worldwide are establishing guidelines that could impact the cryptocurrency market. By staying informed and adaptable, individuals can effectively navigate this dynamic and exciting sector. Remember to continually educate yourself and consider consulting financial experts when delving into cryptocurrency investments.

How AI and Automation are Transforming the Banking Landscape

The advent of AI and automation has profoundly transformed the banking landscape, reshaping how financial institutions operate and interact with customers. With the integration of these advanced technologies, banks can analyze vast amounts of data at unprecedented speeds, enabling them to offer personalized services and improve customer satisfaction. For instance, algorithms can process customer information to provide tailored financial advice, while chatbots and virtual assistants are enhancing customer service by offering real-time support, reducing wait times, and streamlining customer inquiries.

Furthermore, automation plays a pivotal role in enhancing operational efficiency within banks. Processes that traditionally required extensive human intervention, such as loan approvals and compliance checks, are now increasingly automated, resulting in faster turnaround times and reduced operational costs. According to industry experts, the shift towards AI and automated systems not only mitigates risks associated with human error but also ensures regulatory compliance. As a result, financial institutions that embrace these technologies are better positioned to innovate, adapt to market changes, and meet the evolving needs of their customers.