Insightful Chronicles

Your daily dose of news, updates, and insights.

Savings on Wheels: Finding Your Insurance Discounts

Unlock hidden savings! Discover how to score incredible insurance discounts and keep more money in your pocket with our essential tips.

Top 5 Insurance Discounts You Didn't Know You Could Get

Insurance can often feel like an unnecessary expense, but many policyholders are unaware of the top discounts available to them that could significantly lower their premiums. Here are the Top 5 Insurance Discounts you didn't know you could get:

- Bundling Discounts: If you have multiple insurance policies such as auto, home, or life with the same provider, you may qualify for a bundling discount that can save you up to 25%.

- Low Mileage Discounts: Driving less than the average can result in a low mileage discount. If you're working from home or using public transport, be sure to inform your insurer for potential savings.

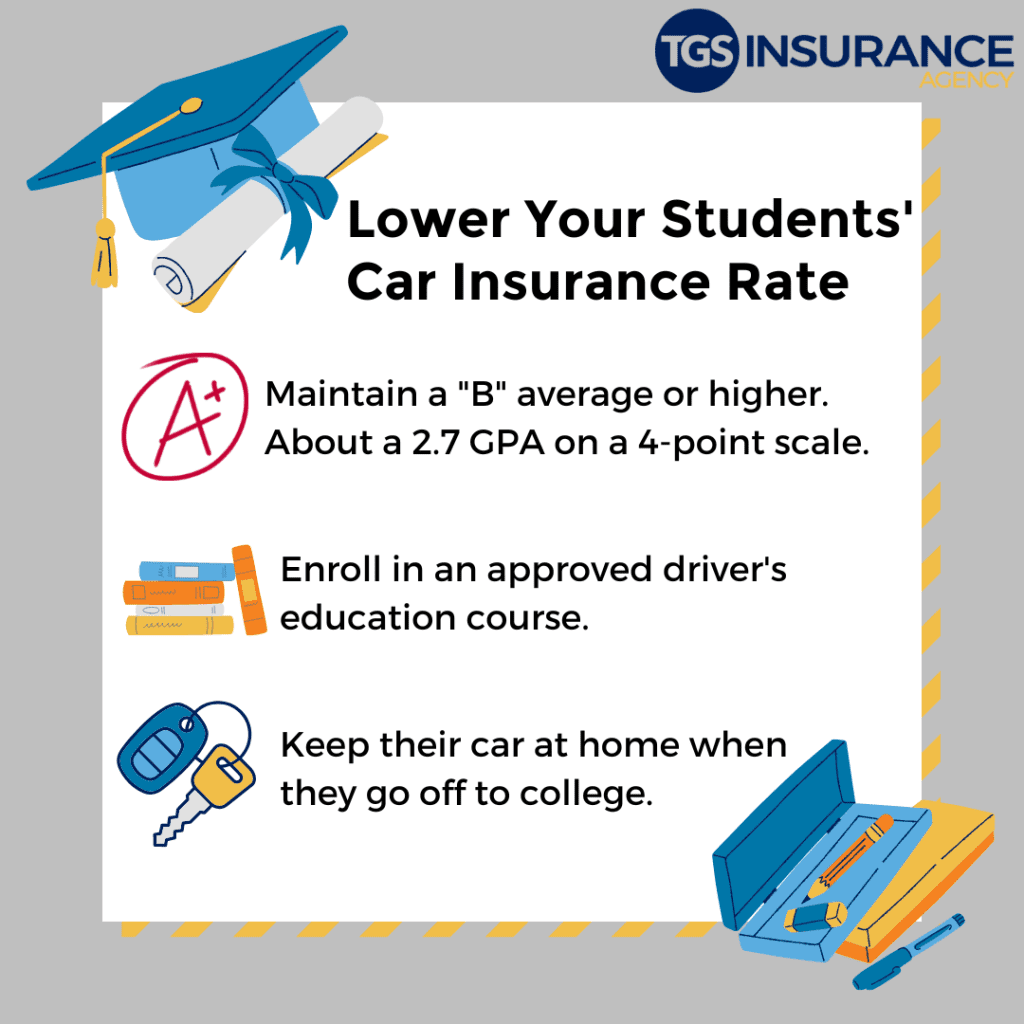

- Good Student Discounts: For young drivers maintains a B average or higher in their studies, many insurers offer significant savings as a reward for their academic achievements.

- Home Safety Discounts: Installing safety features like alarm systems or deadbolts in your home can qualify you for discounts on your home insurance.

- Claims-Free Discounts: If you have not filed a claim for several years, you might be eligible for a claims-free discount, which can further decrease your monthly payments.

How to Find Hidden Discounts on Your Auto Insurance

Finding hidden discounts on your auto insurance can significantly lower your premiums. Start by reviewing your policy every year to ensure you are taking advantage of all available discounts. Many insurers offer reduced rates for safe driving, multiple policies, or even affiliation with certain organizations, such as employers or schools. Additionally, consider asking your insurance agent directly about any lesser-known discounts, as these may not be prominently advertised.

Another effective strategy to uncover hidden discounts is to maintain a good credit score. Many insurance companies use credit scores as a factor in determining rates. You can also look into taking a defensive driving course, which often earns you discounts with various providers. Lastly, don’t forget to shop around and compare quotes from different insurers; a rate that seems competitive may hide additional discounts that could save you even more money.

Are You Missing Out on These Common Insurance Savings Opportunities?

In today's increasingly competitive insurance market, many consumers are unaware of the savings opportunities that may be available to them. This oversight can result in paying much more than necessary for coverage. Common savings avenues include bundling policies, which often provides substantial discounts for those who combine their home and auto insurance with a single provider. Additionally, many insurers offer loyalty discounts that reward long-time customers. Reviewing your policy regularly and shopping around every few years can also expose potential savings that are being overlooked.

Another common insurance savings opportunity involves taking advantage of various discounts related to your lifestyle and circumstances. For instance, many insurers provide savings for safe driving, which can be verified through telematics devices or mobile apps that track driving behavior. Furthermore, maintaining a good credit score can significantly influence your premium rates. Consider asking your insurer about any available discounts for being a member of certain organizations or for completing defensive driving courses. By being proactive and informed about these opportunities, you can ensure you're not missing out on valuable savings.