Insightful Chronicles

Your daily dose of news, updates, and insights.

Offshore Banks: Where Your Money Goes on Vacation

Discover how offshore banks can make your money work for you while you relax. Uncover the secrets of financial freedom today!

The Benefits of Offshore Banking: Is Your Money Really on Vacation?

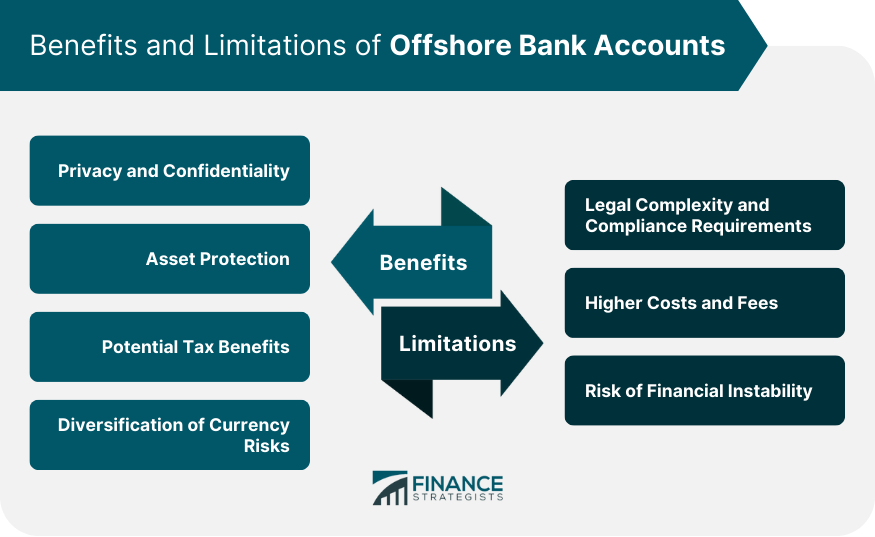

Offshore banking offers a variety of benefits that can significantly enhance your financial strategy. One of the primary advantages is the potential for increased privacy. Many offshore banks provide robust confidentiality policies, allowing your financial activities to remain discreet. Additionally, offshore accounts can offer favorable tax benefits, depending on the jurisdiction. While it's crucial to comply with international tax laws, utilizing an offshore bank can lead to strategic tax planning, thereby preserving more of your wealth.

Moreover, an offshore bank account can serve as a safeguard against economic instability. By diversifying your assets internationally, you can protect your finances from domestic economic downturns or fluctuating currencies. Many offshore banks also offer multicurrency accounts, which enable clients to hold and transact in various currencies, providing even greater flexibility. In summary, while your money may be having a 'vacation' in an offshore account, it can simultaneously work hard for your financial future, allowing for both growth and security.

Top 5 Offshore Banking Myths Debunked: What You Need to Know

Offshore banking is often shrouded in misinformation and myth, leading to misconceptions that can deter individuals and businesses from exploring their benefits. One common myth is that offshore accounts are exclusively for the wealthy or those looking to dodge taxes. In reality, offshore banking is accessible to a wide range of individuals and can serve legitimate purposes such as asset protection and diversification of investments. Furthermore, many offshore jurisdictions offer accounts with low minimum balance requirements, making them suitable for everyday savers as well.

Another prevalent myth is the belief that all offshore banks are inherently illegal or unethical. However, reputable offshore banks operate under strict regulatory frameworks and adhere to international banking laws. In fact, these institutions often provide enhanced privacy and security for their clients' assets. It's essential to conduct thorough research and choose an established bank that complies with regulatory standards. By dispelling these myths, individuals can better understand the legitimate advantages of offshore banking for personal and business finance management.

How to Choose the Right Offshore Bank for Your Financial Goals

Choosing the right offshore bank is a crucial step in achieving your financial goals. Start by identifying your specific needs, such as privacy, asset protection, or investment opportunities. It’s essential to consider the bank's reputation and regulatory compliance in its home country. Look for institutions that are well-established with a solid track record of customer satisfaction and transparency. You can also check for reviews and ratings from current or past clients to gauge the bank's reliability and service quality.

Next, assess the range of services offered by potential offshore banks. Create a checklist of features that are important to you, such as currency options, account types, and fees. Many banks provide accounts in multiple currencies and specialized services like wealth management or international investments. Make sure to compare the terms and conditions carefully, keeping an eye on minimum deposit requirements and withdrawal restrictions. By systematically evaluating these factors, you can ensure that you choose a bank that aligns with your financial aspirations.